The Metrics That Matter: Measuring the Real ROI of AI Integration

Recent case studies reveal organizations are achieving 70% cost reductions and double-digit productivity gains through strategic AI implementation. Learn the KPIs that demonstrate AI's true value.

July 7, 2025 | The Moccet Team

Key Takeaway

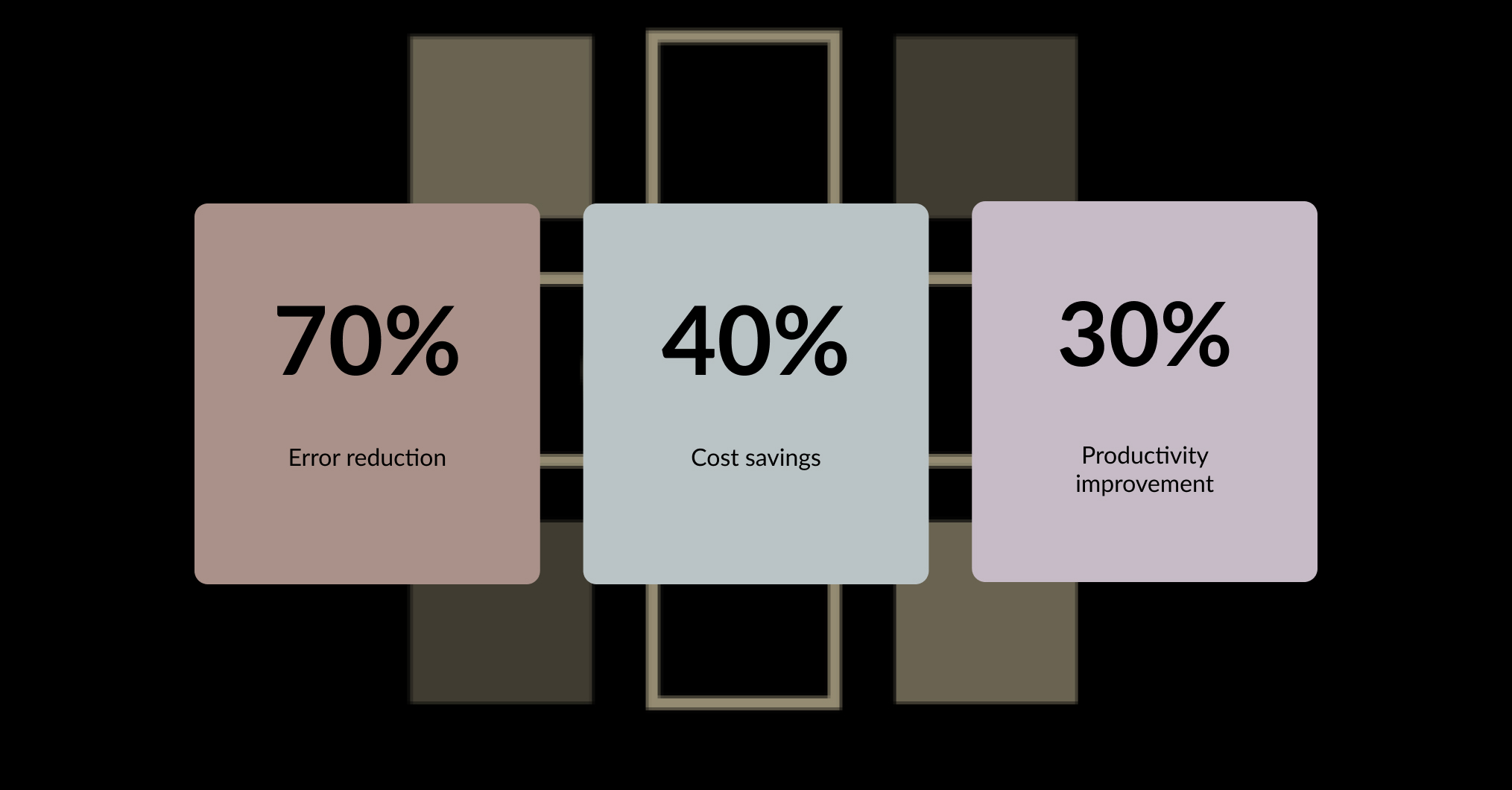

Real-world AI implementations are delivering measurable returns: 97% of business leaders plan to increase GenAI investments, with organizations achieving 330% ROI over three years according to Forrester research. McKinsey studies show AI could add $2.6-4.4 trillion annually to the global economy, while specific case studies demonstrate 70% error reductions, 30-45% productivity improvements, and 23-30% efficiency gains across industries.

The biggest challenge facing organizations implementing AI isn't the technology itself—it's proving its value. According to a 2024 KPMG survey, 97% of business leaders planned to increase GenAI investments within 12 months, with 43% expecting to spend over $100 million. Yet nearly the same percentage admit they struggle to demonstrate business value from their current GenAI pilots.

This ROI measurement gap is creating what researchers call "ROI tension"—companies are pouring money into AI while scrutinizing those projects more closely than ever. S&P Global data shows that the share of companies abandoning most of their AI projects jumped to 42% in 2025 from just 17% the year prior, often citing cost and unclear value as top reasons. Success requires sophisticated measurement approaches that capture AI's multifaceted benefits.

The Scale of AI's Economic Impact

McKinsey research provides compelling evidence of AI's transformative potential, estimating that generative AI could add between $2.6 trillion to $4.4 trillion annually across 63 analyzed use cases. To put this in perspective, the United Kingdom's entire GDP in 2021 was $3.1 trillion. This represents a 15 to 40 percent increase over the $11 trillion to $17.7 trillion of economic value that traditional AI and analytics could already unlock.

AI's Economic Value by Industry Sector

- Technology Sector: Up to 9% of global industry revenue potential impact

- Banking & Financial Services: Up to 5% revenue impact potential

- Pharmaceuticals & Medical Products: Up to 5% revenue impact

- Education: Up to 4% revenue impact potential

- Customer Operations: 30-45% productivity increase potential

- Marketing & Sales: 3-5% potential revenue increase

"We continue to see large impacts on labor productivity in the limited areas where generative AI has been deployed. Academic studies imply a 23% uplift to productivity, while company anecdotes imply slightly larger gains of around 30%."

— Goldman Sachs Research, 2024

Real-World Case Studies: Quantifying AI Value

The most compelling evidence of AI ROI comes from documented case studies across industries. Forrester Consulting's 2024 Total Economic Impact study of SS&C Blue Prism's intelligent automation platform provides a comprehensive example of measurable AI returns.

Forrester TEI Study: 330% ROI in Three Years

The Forrester study examined organizations using SS&C Blue Prism's intelligent automation platform and found a composite customer achieving a 330% return on investment over three years, representing a net present value of $53.4 million. Key quantified benefits included:

- • Revenue Growth: 5.4% compound annual growth rate over three years

- • Productivity Gains: 8% increase in overall productivity

- • Employee Retention: 7.3% improvement in retention rates

- • Payback Period: Less than six months

- • Business Growth: 73% of overall net present value benefit attributed to revenue growth

Among 166 respondents surveyed, 60% reported speed, productivity, accuracy, and auditability improvements as top benefits, while 65% achieved extended value across end-to-end processes.

BCG Case Study: Oil & Gas Maintenance Operations

Boston Consulting Group documented an oil and gas company that implemented GenAI to enhance maintenance operations, achieving:

Industry-Specific ROI Measurements

Different industries are experiencing varying levels of AI ROI based on their specific use cases and implementation strategies. McKinsey research and industry surveys provide concrete data on sector-specific benefits.

Customer Service & Operations

Customer care represents one of the highest-impact AI applications. McKinsey research shows that up to 50% of customer care activities could be automated, with potential for 30-45% productivity increases while improving customer experience and satisfaction scores. Real-world implementations demonstrate significant cost reductions and efficiency gains.

Telecommunications Case Study

A leading telecommunications company integrated an AI-powered chatbot for billing, account management, and technical support, achieving a 30% reduction in call center costs. The AI system handled routine questions, allowing reallocation of human agents to complex technical issues.

E-commerce Implementation

An e-commerce giant deployed AI-driven virtual assistants for order tracking, product recommendations, and refund requests, reporting a 40% reduction in customer service expenses while improving response times and customer satisfaction rates.

Supply Chain & Manufacturing

According to McKinsey's State of AI survey, 41% of supply chain management respondents saw cost reductions of 10-19% after implementing AI, while 32% of manufacturing departments experienced similar savings.

The Four-Pillar Framework for AI ROI Measurement

Based on research from leading consulting firms and real-world implementations, organizations that successfully measure AI ROI use a comprehensive four-pillar approach that captures both immediate and compound benefits.

Pillar 1: Direct Cost Savings (Hard ROI)

Hard ROI metrics focus on quantifiable, monetary benefits directly attributable to AI implementation. PwC research identifies several key sources of direct cost savings from AI investments.

- Time Savings: Automated processes reduce time needed for manual tasks (e.g., invoice processing using AI)

- Productivity Increases: Enhanced decision-making capabilities increase employee output by 20-30%

- Labor Cost Reduction: Some organizations achieve reduced staffing needs through automation

- Error Reduction: AI systems minimize costly mistakes and rework

- Resource Optimization: Better allocation of materials, inventory, and assets

Pillar 2: Revenue Enhancement Metrics

McKinsey's survey data shows that 63% of enterprises experienced revenue increases of up to 10% or more following AI adoption, with 41% of marketing and sales teams generating 6-10% higher revenues.

Pillar 3: Operational Efficiency Improvements

According to Deloitte research, predictive maintenance powered by AI can enhance productivity by 25%, decrease breakdowns by 70%, and lower maintenance costs by 25%. These operational improvements compound over time.

Pillar 4: Strategic Value Creation (Soft ROI)

Soft ROI encompasses qualitative benefits that may not have immediate financial impact but create long-term value: improved employee satisfaction, enhanced customer experience, better decision-making capabilities, and increased innovation capacity.

AI ROI Success Factors: What High Performers Do Differently

Research shows that AI high performers—organizations where at least 20% of EBIT in 2022 was attributable to AI use—approach ROI measurement differently than other organizations. These leaders achieve consistently higher returns through systematic approaches.

High Performer Characteristics

According to McKinsey's State of AI research, high-performing organizations share common traits:

- • Comprehensive Implementation: Using AI in more business functions than other organizations

- • Strategic Focus: Concentrating on high-value areas like product development and risk management

- • Measurement Discipline: Rigorous tracking of both quantitative and qualitative benefits

- • Continuous Optimization: Regular assessment and improvement of AI systems

- • Executive Support: Strong leadership commitment to AI transformation

Measuring ROI Timeline and Expectations

Forrester's Q2 AI Pulse Survey found that 49% of U.S. GenAI decision-makers expect ROI on AI investments within one to three years, while 44% expect returns within three to five years. However, successful implementations often see benefits much sooner.

Short-Term (3-6 months)

- • Process automation benefits

- • Basic productivity improvements

- • Initial cost savings from reduced manual work

- • Employee time savings

Medium-Term (6-18 months)

- • Significant productivity gains

- • Revenue enhancement effects

- • Quality improvement benefits

- • Customer satisfaction improvements

Long-Term (18+ months)

- • Strategic capability development

- • Competitive advantage realization

- • Innovation acceleration

- • Market position improvements

Implementation Best Practices for ROI Measurement

Organizations achieving the highest AI ROI follow systematic approaches to implementation and measurement. Based on successful case studies and research findings, several best practices emerge.

Establish Baseline Metrics Before Implementation

Successful organizations capture comprehensive baseline measurements across all four ROI pillars before AI deployment. This includes current process times, error rates, costs, and productivity levels.

Focus on High-Impact Use Cases

McKinsey research indicates that 75% of AI's total annual value comes from four key areas: customer operations, marketing and sales, software engineering, and R&D. Organizations should prioritize these high-impact applications.

Implement Continuous Monitoring

High-performing organizations establish continuous monitoring systems that track both leading indicators (usage rates, user adoption) and lagging indicators (cost savings, revenue impact). This enables rapid optimization and demonstrates ongoing value.

"Organizations that have large workforces in the field can improve operational workflows with GenAI, improving the productivity of individual employees by 20% to 30%."

— Boston Consulting Group, 2025

Overcoming Common ROI Measurement Challenges

Despite proven benefits, organizations face several challenges in measuring AI ROI effectively. Understanding and addressing these challenges is crucial for successful AI value capture.

Challenge 1: Attribution Complexity

AI often works alongside other improvements, making it difficult to isolate AI's specific contribution. Solution: Use controlled testing environments and statistical attribution models to separate AI impact from other factors.

Challenge 2: Long-Term Value Recognition

Traditional ROI calculations may miss AI's compound benefits that accumulate over time. Solution: Implement multi-timeframe measurement approaches that capture both immediate and strategic value.

Challenge 3: Soft Benefits Quantification

Benefits like improved decision-making and employee satisfaction are difficult to quantify. Solution: Develop proxy metrics and correlational studies that link soft benefits to measurable business outcomes.

The Future of AI ROI Measurement

As AI capabilities advance, measurement approaches are evolving to capture increasingly sophisticated value creation. Goldman Sachs projects that AI could eventually drive a 7% increase in global GDP and lift productivity growth by 1.5 percentage points over a 10-year period.

Future measurement frameworks will need to account for:

- Autonomous Decision-Making Value: ROI from AI systems that make independent decisions

- Innovation Acceleration: Measuring AI's impact on R&D speed and breakthrough development

- Ecosystem Effects: Value creation through AI-enabled partnerships and market expansion

- Adaptive Learning Benefits: ROI improvements as AI systems become smarter over time

Conclusion: The ROI Imperative

The evidence is overwhelming: organizations implementing strategic AI initiatives with comprehensive ROI measurement are achieving remarkable returns. From Forrester's documented 330% ROI to McKinsey's projected $4.4 trillion annual economic impact, AI's value potential is both substantial and measurable.

Success requires moving beyond pilot mode to production-scale implementations with rigorous measurement frameworks. As one Forrester study participant noted, "Over the last five years, IA has moved from addressing mainly operational challenges to more strategic challenges." Organizations that master AI ROI measurement today will capture the compound benefits that define competitive advantage tomorrow.

Measure AI ROI with Research-Proven Frameworks

moccet's platform incorporates the same ROI measurement frameworks validated in Forrester, McKinsey, and Goldman Sachs research. Our comprehensive analytics track both hard and soft ROI metrics across the four-pillar framework, enabling you to demonstrate the 330% ROI potential and 30% productivity gains documented in industry studies. Experience AI implementation with built-in measurement that proves value from day one.Start measuring proven AI ROI today.